Lord RCV2PM

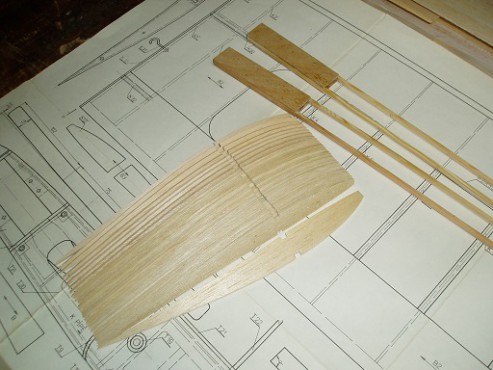

Lord RCV2PM podle plánu modelář 156 S. František Hrbáček původní plán malinko změnil motor MVVS 2,5 nahradí stejnosměrným motorem ROBBE 6-8V,bude pohánět Lipol baterie 2S 2200 mAh s převodovkou modela ,sklopnou vrtuli prodávanou v 70 letech.

Vzepětí křídel zmenšeno na 50% . odřezání odtokové hrany pro křidélka.

Edit 24.1.2015

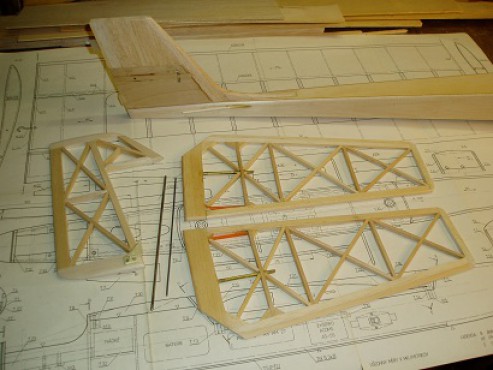

Směrové kormidlo s plovoucí výškovkou.

Edit 4.2.2015

Lord před potažením...

Edit 11.2.2015

Potaženo , stačí doladit těžiště a hurá na zálet. Františku máš to moc hezké, ať to taky tak hezky lítá.Lord je připraven k letu František čeká na příznivější počasí. Letu zdar.

Edit 14.2.2015

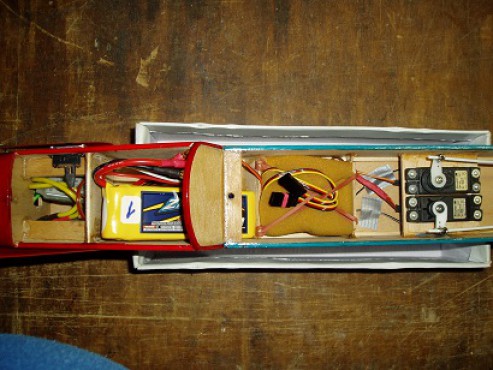

Rozmístění rc vybavení, standartní serva C5077 a C507 ,dvoučlánek 2200mAh, stejnosměrný regulátor 25A MGM ComPro.

Edit 22.2.2015

Včera při pěkném ikdyž chladném počasí František udělal zálet elektro Lorda. Podle jeho slov letí krásně , postupně ho doladí ke své úplné spokojenosti .

Foto: Jiří Pastrnek

Vice foto zde:

Komentáře

Přehled komentářů

https://clck.ru/36Evhs

ININKANYMN - UNCENSORED!

Seeking the untold stories of warfare? Our Telegram channel unveils raw, unfiltered footage: intense tanks in turmoil, helicopters painting the sky, infantry precision, and kamikaze drones rewriting strategies. Join us for an unvarnished exploration into the realities that challenge the norm.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

Jamestig - 娛樂城

2024娛樂城的創新趨勢

隨著2024年的到來,娛樂城業界正經歷著一場革命性的變遷。這一年,娛樂城不僅僅是賭博和娛樂的代名詞,更成為了科技創新和用戶體驗的集大成者。

首先,2024年的娛樂城極大地融合了最新的技術。增強現實(AR)和虛擬現實(VR)技術的引入,為玩家提供了沉浸式的賭博體驗。這種全新的遊戲方式不僅帶來視覺上的震撼,還為玩家創造了一種置身於真實賭場的感覺,而實際上他們可能只是坐在家中的沙發上。

其次,人工智能(AI)在娛樂城中的應用也達到了新高度。AI技術不僅用於增強遊戲的公平性和透明度,還在個性化玩家體驗方面發揮著重要作用。從個性化遊戲推薦到智能客服,AI的應用使得娛樂城更能滿足玩家的個別需求。

此外,線上娛樂城的安全性和隱私保護也獲得了顯著加強。隨著技術的進步,更加先進的加密技術和安全措施被用來保護玩家的資料和交易,從而確保一個安全可靠的遊戲環境。

2024年的娛樂城還強調負責任的賭博。許多平台採用了各種工具和資源來幫助玩家控制他們的賭博行為,如設置賭注限制、自我排除措施等,體現了對可持續賭博的承諾。

總之,2024年的娛樂城呈現出一個高度融合了技術、安全和負責任賭博的行業新面貌,為玩家提供了前所未有的娛樂體驗。隨著這些趨勢的持續發展,我們可以預見,娛樂城將不斷地創新和進步,為玩家帶來更多精彩和安全的娛樂選擇。

Edwardsuest - 娛樂城

2024娛樂城的創新趨勢

隨著2024年的到來,娛樂城業界正經歷著一場革命性的變遷。這一年,娛樂城不僅僅是賭博和娛樂的代名詞,更成為了科技創新和用戶體驗的集大成者。

首先,2024年的娛樂城極大地融合了最新的技術。增強現實(AR)和虛擬現實(VR)技術的引入,為玩家提供了沉浸式的賭博體驗。這種全新的遊戲方式不僅帶來視覺上的震撼,還為玩家創造了一種置身於真實賭場的感覺,而實際上他們可能只是坐在家中的沙發上。

其次,人工智能(AI)在娛樂城中的應用也達到了新高度。AI技術不僅用於增強遊戲的公平性和透明度,還在個性化玩家體驗方面發揮著重要作用。從個性化遊戲推薦到智能客服,AI的應用使得娛樂城更能滿足玩家的個別需求。

此外,線上娛樂城的安全性和隱私保護也獲得了顯著加強。隨著技術的進步,更加先進的加密技術和安全措施被用來保護玩家的資料和交易,從而確保一個安全可靠的遊戲環境。

2024年的娛樂城還強調負責任的賭博。許多平台採用了各種工具和資源來幫助玩家控制他們的賭博行為,如設置賭注限制、自我排除措施等,體現了對可持續賭博的承諾。

總之,2024年的娛樂城呈現出一個高度融合了技術、安全和負責任賭博的行業新面貌,為玩家提供了前所未有的娛樂體驗。隨著這些趨勢的持續發展,我們可以預見,娛樂城將不斷地創新和進步,為玩家帶來更多精彩和安全的娛樂選擇。

ININKANYMN - Videos that shocked the internet!

Greetings, truth-seekers! Our Telegram channel brings you uncensored combat footage. Join us to witness the reality that shapes our world!

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

Edwardsuest - 娛樂城

2024娛樂城的創新趨勢

隨著2024年的到來,娛樂城業界正經歷著一場革命性的變遷。這一年,娛樂城不僅僅是賭博和娛樂的代名詞,更成為了科技創新和用戶體驗的集大成者。

首先,2024年的娛樂城極大地融合了最新的技術。增強現實(AR)和虛擬現實(VR)技術的引入,為玩家提供了沉浸式的賭博體驗。這種全新的遊戲方式不僅帶來視覺上的震撼,還為玩家創造了一種置身於真實賭場的感覺,而實際上他們可能只是坐在家中的沙發上。

其次,人工智能(AI)在娛樂城中的應用也達到了新高度。AI技術不僅用於增強遊戲的公平性和透明度,還在個性化玩家體驗方面發揮著重要作用。從個性化遊戲推薦到智能客服,AI的應用使得娛樂城更能滿足玩家的個別需求。

此外,線上娛樂城的安全性和隱私保護也獲得了顯著加強。隨著技術的進步,更加先進的加密技術和安全措施被用來保護玩家的資料和交易,從而確保一個安全可靠的遊戲環境。

2024年的娛樂城還強調負責任的賭博。許多平台採用了各種工具和資源來幫助玩家控制他們的賭博行為,如設置賭注限制、自我排除措施等,體現了對可持續賭博的承諾。

總之,2024年的娛樂城呈現出一個高度融合了技術、安全和負責任賭博的行業新面貌,為玩家提供了前所未有的娛樂體驗。隨著這些趨勢的持續發展,我們可以預見,娛樂城將不斷地創新和進步,為玩家帶來更多精彩和安全的娛樂選擇。

Bernardrax - 娛樂城

2024娛樂城的創新趨勢

隨著2024年的到來,娛樂城業界正經歷著一場革命性的變遷。這一年,娛樂城不僅僅是賭博和娛樂的代名詞,更成為了科技創新和用戶體驗的集大成者。

首先,2024年的娛樂城極大地融合了最新的技術。增強現實(AR)和虛擬現實(VR)技術的引入,為玩家提供了沉浸式的賭博體驗。這種全新的遊戲方式不僅帶來視覺上的震撼,還為玩家創造了一種置身於真實賭場的感覺,而實際上他們可能只是坐在家中的沙發上。

其次,人工智能(AI)在娛樂城中的應用也達到了新高度。AI技術不僅用於增強遊戲的公平性和透明度,還在個性化玩家體驗方面發揮著重要作用。從個性化遊戲推薦到智能客服,AI的應用使得娛樂城更能滿足玩家的個別需求。

此外,線上娛樂城的安全性和隱私保護也獲得了顯著加強。隨著技術的進步,更加先進的加密技術和安全措施被用來保護玩家的資料和交易,從而確保一個安全可靠的遊戲環境。

2024年的娛樂城還強調負責任的賭博。許多平台採用了各種工具和資源來幫助玩家控制他們的賭博行為,如設置賭注限制、自我排除措施等,體現了對可持續賭博的承諾。

總之,2024年的娛樂城呈現出一個高度融合了技術、安全和負責任賭博的行業新面貌,為玩家提供了前所未有的娛樂體驗。隨著這些趨勢的持續發展,我們可以預見,娛樂城將不斷地創新和進步,為玩家帶來更多精彩和安全的娛樂選擇。

ININKANYMN - How kamikaze drones destroy machinery and buildings

Greetings, reality explorers! Break away from the mundane and join our Telegram channel for uncut, uncensored footage offering a different perspective. Explore the unvarnished truths shaping our world.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

Shaneasdmug - Где Купить Гашиш? САЙТ - KOKS24.CC Как Купить Гашиш? САЙТ - KOKS24.CC

Где Купить Гашиш? САЙТ - KOKS24.CC Как Купить Гашиш? САЙТ - KOKS24.CC

КАК КУПИТЬ ГАШИШ НА САЙТЕ - https://koks24.cc/

КАК ЗАКАЗАТЬ ЧЕРЕЗ ТЕЛЕГРАММ - https://koks24.cc/

ГДЕ ДОСТАВКА ГАШИША В РУКИ - https://koks24.cc/

ГДЕ ЗАКЛАДКА ГАШИША ОНЛАЙН - https://koks24.cc/

ТУТ ССЫЛКА В ТЕЛЕГРАММ - https://koks24.cc/

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Теги поисковых слов для запроса "Где Купить Гашиш В Москве и Питере"

Где Купить Гашиш в Москве и Питере?

Как Купить закладку Гашиша в Москве и Питере?

Цена на Гашиш в Москве и Питере?

Купить Гашиш с Доставкой в руки в Москве и Питере?

Сколько Стоит Гашиш в Москве и Питере?

Почему так просто Купить Гашиш закладкой в Москвеи Питере?

Гарантия на Гашиш в Москвеи Питере?

Купить Гашиш с Гарантией?

Круглосуточные магазины Гашиша в Москве и Питере?

Оптовые и Розничные продажи Гашиша в Москве и Питере?

Купить Гашиш в Москве и Питере через Телеграмм?

Лучший Гашиш Купить в Москве и Питере?

Купить Гашиш в Москве и Питере по скидке и хорошей цене?

Купить Гашиш в Москве и Питере через свой телефон или ноутбук можно легко?

Сколько где Гашиша стоит цена?

Как купить Гашиш в Москве и Питере если нет очень много денег и нужно угостить девушку?

С кем можно разделить грамм Гашиш в Москве и Питере?

Не плохой или хороший Гашиш можно Купить в Москве и Питере на своей улице закладкой?

Гашиш Купить Где Москва и Питер ?

Основные теги - Купить Гашиш в Москве, Купить Гашиш в Новосибирске, Купить Гашиш в Санкт-Петербурге, Купить Гашиш в Екатеринбурге, Купить Гашиш в Казани,

Купить Гашиш в Нижнем Новгороде, Купить Гашиш в Красноярске, Купить Гашиш в Челябинске, Купить Гашиш в Уфе, Купить Гашиш в Самаре,

Купить Гашиш в Ростове на Дону, Купить Гашиш в Краснодаре, Купить Гашиш в Омске, Купить Гашиш в Воронеже, Купить Гашиш в Перьми, Купить Гашиш в Волгограде.

Дополнительные теги - Купить Шишки в Москве, Купить экстази в Москве , Купить гашиш в Москве, Купить мефедрон в Москве, Купить экстази в Москве, Купить МДМА в Москве,

Купить лсд в Москве, Купить Амфетамин в Москве, Купить скорость альфа ПВП в Москве, Купить гидропонику в Москве, Купить метамфетамин в Москве, Купить эйфоретики в Москве,

Купить закладки в Москве, Купить ШИШКИ закладкой в Москве , Купить Стимуляторы в Москве, Купить Галлюцыногены в Москве, Купить Наркотики закладкой в Москве. Тег окончен

DanielkaVem - Купить Амфетамин в Киеве? САЙТ - KOKS.TOP Купить Амфетамин Киев? САЙТ - KOKS.TOP

Купить Амфетамин в Киеве? САЙТ - KOKS.TOP Купить Амфетамин Киев? САЙТ - KOKS.TOP

ДОСТАВКА ТОВАРА В РУКИ - https://koks.top/

ЗАКАЗЫ ОНЛАЙН ЧЕРЕЗ ТЕЛЕГРАММ - https://koks.top/

ЗАКЛАДКИ ОНЛАЙН НА САЙТЕ - https://koks.top/

ССЫЛКА ДЛЯ СВЯЗИ С ОПЕРАТОРОМ - https://koks.top/

КУПИТЬ АМФЕТАМИН ОНЛАЙН С ДОСТАВКОЙ - https://koks.top/

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Теги поисковых слов для запроса "Купить Амфетамин в Киеве"

Сколько Стоит Амфетамин в Киеве в розницу? Кто обычно покупает Амфетамин в Киеве? Как изготавливают Амфетамин который можно купить в Киеве?

Сколько лет уже продают качественный Амфетамин в Киеве закладками? Как можно купить Амфетамин в Киеве с доставкой в руки?

Надежность покупок Амфетамин в Киеве с максимальной скоростью доставки товара в руки? Какой минимальный заказ покупки Амфетамин в Киеве при заказе онлайн?

Самый быстрый способ Купить Амфетамин в Киеве без посредников? Купить Амфетамин в киеве на прямую без третьих лиц? Сколько нужно грамм для употребления Амфетамина в Киеве?

Мой друг знает где быстро Купить Амфетамин в Киеве в ночное время суток без номера телефона курьера, всё полностью онлайн и анонимно!

Если есть желание покупать Амфетамин в Киеве по самой демократичной и низкой цене по сравнению с качеством то Вам несомненно нужно посетить сайт на котором продают Амфетамин в Киеве?

Амфетамин в Киеве после которого нет головных болей, ломоты в суставе и ломки как после уличных наркотиков? Бесплатная доставка Амфетамина в Киеве по средах каждого месяца!

Мелкие и крупные покупки Амфетамина в Киеве, Оптом Амфетамин в Киеве? В розницу Амфетамин в Киеве? Всё это без проблем может обеспечить всего один сайт в кратчайшие сроки!

Челоек - Паук вместо паутины плетёт Амфетаминовую нить, которую иногда можно перепутать с Амфетамином в Киеве по самой доступной цене на этом узкопрофильном рынке!

Каждая собака в Киеве знает где купить Амфетамин на розвес так сказать, разфасованный товар до милиграмма с точностью швейцарских часов Киевских Амфетаминовых весов?

Моя молодая подруга мне подсказала где в Киеве Купить Амфетамин такого качества, что потом весь остальной Амфетамин тв Киеве можно будет просто выкинуть в мусорку без сомнения?

Наш Амфетамин в Киеве- просто перчик? Про такой Амфетамин в Киеве даже соченили уже репчик? Какие молодцы люди, которые понимают в качестве и основных ингредиентах приготовления такого Амфетамина в Киеве?

Меня на улице спросили - Где же мы Можем Купить Амфетаминн в Киеве? И я с гордостью ответил - Амфетамин в Киеве вы всегда можете преобрести онлайн на официальном доверенном сайте который продает Амфетамин в Киеве.

Какими способностями обладают люди, которые употребляют Амфетамин в Киеве без сна даже трое суток, спросите вы? А я отвечу - спустя даже три дня человек употребивший Амфетамин в Киеве чувствует прилив сил и бодрость!

Мне в замаскированной посылке привезли Амфетамин в Киеве очень хорошего качества товар для оборота, было много но я не ожидал что будет больше чем нужно?

Общие Теги для Гугл бот - Купить Шишки в Киеве, Купить экстази в Киеве , Купить гашиш в Киеве, Купить мефедрон в Киеве, Купить экстази в Киеве, Купить МДМА в Киеве,

Купить лсд в Киеве, Купить Амфетамин в Киеве, Купить скорость альфа ПВП в Киеве, Купить гидропонику в Киеве, Купить метамфетамин в Киеве, Купить эйфоретики в Киеве,

Купить закладки в Киеве, Купить ШИШКИ закладкой в Киеве , Купить Стимуляторы в Киеве, Купить Галлюцыногены в Киеве. Тег окончен

Domenic - I am the new one

1xBet – одна из самых популярных букмекерских контор в России и странах СНГ.

Промокод 1хбет кз на бесплатную ставку Компания предлагает широкий выбор ставок на спорт, включая

футбол, хоккей, баскетбол, теннис и другие

популярные виды спорта. 1xBet также предлагает возможность делать ставки на живые события, что позволяет игрокам

следить за матчем и менять свои ставки

в режиме реального времени.

Компания имеет удобный интерфейс и множество вариантов

для пополнения и вывода средств.

1xBet также предлагает широкий выбор

бонусов и акций для своих игроков.

Более того, 1xBet имеет приложение для мобильных устройств, что

позволяет игрокам делать ставки в любое время и

в любом месте. В целом, 1xBet - это надежная и удобная платформа

для тех, кто хочет делать ставки на

спорт.

Gregoryalob - Где Купить Мефедрон? САЙТ - KOKS24.CC Как Купить Мефедрон? САЙТ - KOKS24.CC

Где Купить Мефедрон? САЙТ - KOKS24.CC Как Купить Мефедрон? САЙТ - KOKS24.CC

КАК КУПИТЬ МЕФЕДРОН НА САЙТЕ - https://koks24.cc/

КАК ЗАКАЗАТЬ ЧЕРЕЗ ТЕЛЕГРАММ - https://koks24.cc/

ГДЕ ДОСТАВКА МЕФЕДРОНА В РУКИ - https://koks24.cc/

ГДЕ ЗАКЛАДКА МЕФЕДРОНА ОНЛАЙН - https://koks24.cc/

ТУТ ССЫЛКА В ТЕЛЕГРАММ - https://koks24.cc/

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Теги поисковых слов для запроса "Где Купить Мефедрон В Москве и Питере"

Где Купить Мефедрон в Москве и Питере?

Как Купить закладку Мефедрона в Москве и Питере?

Цена на Мефедрон в Москве и Питере?

Купить Мефедрон с Доставкой в руки в Москве и Питере?

Сколько Стоит Мефедрон в Москве и Питере?

Почему так просто Купить Мефедрон закладкой в Москвеи Питере?

Гарантия на Мефедрон в Москвеи Питере?

Купить Мефедрон с Гарантией?

Круглосуточные магазины Мефедрона в Москве и Питере?

Оптовые и Розничные продажи Мефедрона в Москве и Питере?

Купить Мефедрон в Москве и Питере через Телеграмм?

Лучший Мефедрон Купить в Москве и Питере?

Купить Мефедрон в Москве и Питере по скидке и хорошей цене?

Купить Мефедрон в Москве и Питере через свой телефон или ноутбук можно легко?

Сколько где Мефедрона стоит цена?

Как купить Мефедрон в Москве и Питере если нет очень много денег и нужно угостить девушку?

С кем можно разделить грамм Мефедрон в Москве и Питере?

Не плохой или хороший Мефедрон можно Купить в Москве и Питере на своей улице закладкой?

Мефедрон Купить Где Москва и Питер ?

Основные теги - Купить мефедрон в Москве, Купить Мефедрон в Новосибирске, Купить Мефедрон в Санкт-Петербурге, Купить Мефедрон в Екатеринбурге, Купить Мефедрон в Казани,

Купить Мефедрон в Нижнем Новгороде, Купить Мефедрон в Красноярске, Купить Мефедрон в Челябинске, Купить Мефедрон в Уфе, Купить Мефедрон в Самаре,

Купить Мефедрон в Ростове на Дону, Купить Мефедрон в Краснодаре, Купить Мефедрон в Омске, Купить Мефедрон в Воронеже, Купить Мефедрон в Перьми, Купить Мефедрон в Волгограде.

Дополнительные теги - Купить Шишки в Москве, Купить экстази в Москве , Купить гашиш в Москве, Купить мефедрон в Москве, Купить экстази в Москве, Купить МДМА в Москве,

Купить лсд в Москве, Купить Амфетамин в Москве, Купить скорость альфа ПВП в Москве, Купить гидропонику в Москве, Купить метамфетамин в Москве, Купить эйфоретики в Москве,

Купить закладки в Москве, Купить ШИШКИ закладкой в Москве , Купить Стимуляторы в Москве, Купить Галлюцыногены в Москве, Купить Наркотики закладкой в Москве. Тег окончен

Alfredonrig - Купить Мефедрон в Киеве? САЙТ - KOKS.TOP Купить Мефедрон Киев? САЙТ - KOKS.TOP

Купить Мефедрон в Киеве? САЙТ - KOKS.TOP Купить Мефедрон Киев? САЙТ - KOKS.TOP

ДОСТАВКА ТОВАРА В РУКИ - https://koks.top/

ЗАКАЗЫ ОНЛАЙН ЧЕРЕЗ ТЕЛЕГРАММ - https://koks.top/

ЗАКЛАДКИ ОНЛАЙН НА САЙТЕ - https://koks.top/

ССЫЛКА ДЛЯ СВЯЗИ С ОПЕРАТОРОМ - https://koks.top/

КУПИТЬ МЕФЕДРОН ОНЛАЙН С ДОСТАВКОЙ - https://koks.top/

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Теги поисковых слов для запроса "Купить Мефедрон в Киеве"

Сколько Стоит Мефедрон в Киеве в розницу? Кто обычно покупает Мефедрон в Киеве? Как изготавливают Мефедрон который можно купить в Киеве?

Сколько лет уже продают качественный Мефедрон в Киеве закладками? Как можно купить Мефедрон в Киеве с доставкой в руки?

Надежность покупок Мефедрон в Киеве с максимальной скоростью доставки товара в руки? Какой минимальный заказ покупки Мефедрона в Киеве при заказе онлайн?

Самый быстрый способ Купить Мефедрона в Киеве без посредников? Купить Мефедрон в киеве на прямую без третьих лиц? Сколько нужно грамм для употребления Мефедрон в Киеве?

Мой друг знает где быстро Купить Мефедрон в Киеве в ночное время суток без номера телефона курьера, всё полностью онлайн и анонимно!

Если есть желание покупать Мефедрон в Киеве по самой демократичной и низкой цене по сравнению с качеством то Вам несомненно нужно посетить сайт на котором продают Мефедрон в Киеве?

Мефедрон в Киеве после которого нет головных болей, ломоты в суставе и ломки как после уличных наркотиков? Бесплатная доставка Мефедрона в Киеве по средах каждого месяца!

Мелкие и крупные покупки Мефедрона в Киеве, Оптом Мефедрон в Киеве? В розницу Мефедрон в Киеве? Всё это без проблем может обеспечить всего один сайт в кратчайшие сроки!

Челоек - Паук вместо паутины плетёт Мефедроновую нить, которую иногда можно перепутать с Мефедроном в Киеве по самой доступной цене на этом узкопрофильном рынке!

Каждая собака в Киеве знает где купить Мефедрон на розвес так сказать, разфасованный товар до милиграмма с точностью швейцарских часов Киевских Мефедроновых весов?

Моя молодая подруга мне подсказала где в Киеве Купить Мефедрон такого качества, что потом весь остальной Мефедрон тв Киеве можно будет просто выкинуть в мусорку без сомнения?

Наш Мефедрон в Киеве- просто перчик? Про такой Мефедрон в Киеве даже соченили уже репчик? Какие молодцы люди, которые понимают в качестве и основных ингредиентах приготовления такого Мефедрон в Киеве?

Меня на улице спросили - Где же мы Можем Купить Мефедрон в Киеве? И я с гордостью ответил - Мефедрон в Киеве вы всегда можете преобрести онлайн на официальном доверенном сайте который продает Мефедрон в Киеве.

Какими способностями обладают люди, которые употребляют Мефедрон в Киеве без сна даже трое суток, спросите вы? А я отвечу - спустя даже три дня человек употребивший Мефедрон в Киеве чувствует прилив сил и бодрость!

Мне в замаскированной посылке привезли Мефедрон в Киеве очень хорошего качества товар для оборота, было много но я не ожидал что будет больше чем нужно?

Общие Теги для Гугл бот - Купить Шишки в Киеве, Купить экстази в Киеве , Купить гашиш в Киеве, Купить мефедрон в Киеве, Купить экстази в Киеве, Купить МДМА в Киеве,

Купить лсд в Киеве, Купить Амфетамин в Киеве, Купить скорость альфа ПВП в Киеве, Купить гидропонику в Киеве, Купить метамфетамин в Киеве, Купить эйфоретики в Киеве,

Купить закладки в Киеве, Купить ШИШКИ закладкой в Киеве , Купить Стимуляторы в Киеве, Купить Галлюцыногены в Киеве. Тег окончен

CurtisAlien - В остальном мужчина тоже не советует

В остальном мужчина тоже не советует связываться с этой компанией. Как минимум, потому что она мало кому известна и не регулируется авторитетными надзорными органами.

Не все трейдеры оказали столь осторожными, чтобы не торговать с Esperio. Автор следующего отзыва потерял 2 тысячи долларов на этой платформе. Он пополнял счет через систему WebMoney. К сожалению, обращение к юристам не решило вопрос, процедура чарджбэка в этом случае оказалась недоступной. Клиенту пришлось смириться с потерей, так как все его обращения Esperio все равно проигнорировал.

Еще одна девушка вообще описывает в отзыве порядок работы Esperio. Александра утверждает, что представители компании ищут потенциальных клиентов в социальных сетях. Изначально будущим жертвам предлагают работу, а именно, простое заполнение Excel таблиц. Потом их уговаривают приобрести курс обучения не менее чем за 50 тысяч рублей, и, наконец, самим начать торговлю на платформе Esperio. Естественно, все заканчивается сразу после пополнения. Аналитики, советующие открывать сделки, скорее рано, чем поздно, загоняют депозит трейдера в ноль.

Подтверждает слова Александры Виктория. Она называет Esperio самым ужасным местом работы. Девушка пишет в отзыве, что после месяца оплачиваемой стажировки ей, в конце концов, ничего не перечислили. Зато она регулярно терпела оскорбления от руководства. Виктория не скрывает, что главной ее обязанностью был холодный обзвон и развод людей на деньги.

seotoolsUnopy - Considerations To Know About small seo tools

Select from 3 options: STrack, Regulate and Expand, which range between $29 to $forty four per 30 days when paid annually. The main dissimilarities One of the options entail the diploma of Search engine optimization Device accessibility and the number of experiences you call for to handle various destinations correctly. With The one Business program, you may manage up to a few spots.

It’s almost difficult to improve your Google rankings with out applying Search engine marketing tools for search phrase study, backlink monitoring, competitive Examination and Site optimization audits.

Consumer evaluations are important for area Search engine marketing reasons. This Instrument means that you can make a shareable url for purchasers to evaluation your online business on Google.

SERPWatcher is a popular rank tracking Software that provides buyers with exact and up-to-date knowledge on their Web-site’s internet search engine rankings. It offers a person-friendly interface which makes it simple to navigate and use, even for newbies.

It can discover damaged links, missing page titles and meta descriptions, demonstrate in which tags and titles don’t match and various on-web site Website positioning troubles.

SEO is better for accomplishing bigger visibility on Google in the long run devoid of having to pay Google Ads’ superior advertising expenses. Google Advertisements permits you to improve visibility for your site articles instantly, though you’ll buy that visibility through promoting expenses.

Even though there are a few absolutely free Website positioning applications, the strongest tools arrive in a value. Forbes viewed as if the fees charged for that tools have been consistent with the value made available.

The emphasis on tools, indicating plural, is very important because there isn't any just one magical solution to plop your website atop each and every search results site, at the least not organically, while you'll find finest methods to take action. If you would like purchase a paid out research advertisement spot, then Google AdWords will happily get your money.

Janette Novak is often a freelance journalist and advisor who focuses primarily on teaching online enterprise and small business advertising. Formerly, Janette owned a boutique marketing agency and served to be a Chief Marketing and advertising Officer for a leading Expert coaching expert services company.

https://cuteseotools.com/webtools/word-to-html

During the business Place, 1 major craze we are seeing recently is info import through the large players. Much of Website positioning will involve working with the data Google will give you and then filling in all of the gaps. Google Lookup Console (previously, Webmaster Tools) only provides you with a ninety-working day window of data, so business distributors, such as Conductor and Screaming Frog, are regularly adding and importing information sources from other crawling databases (like DeepCrawl's).

Enter any suitable key phrase, and Solution the Public will offer a enormous listing of lengthy-tail search phrase options, as well as frequent thoughts asked.

https://cuteseotools.com/webtools/youtube-tag-extractor

Use The subject Exploration Device to gather Many new matters connected to your location of fascination. Hone in on the actual concerns persons check with, well-liked headlines in the niche, and trending subtopics!

Enter a URL, and this Instrument will exam the loading time and efficiency for that URL on desktop and cellular. It then grades your site’s general performance on the score from 0 - 100. It lets you know accurately how briskly it will take to load the site As outlined by distinct metrics and also suggests spots for advancement.

At the time the final results are available in, you can use SeedKeywords to complete a Google look for the keyword phrases that men and women gave you.

TerrymskEviff - Где Купить Кокаин? САЙТ - KOKS24.CC Как Купить Кокаин? САЙТ - KOKS24.CC

Где Купить Кокаин? САЙТ - KOKS24.CC Как Купить Кокаин? САЙТ - KOKS24.CC

КАК КУПИТЬ КОКАИН НА САЙТЕ - https://koks24.cc/

КАК ЗАКАЗАТЬ ЧЕРЕЗ ТЕЛЕГРАММ - https://koks24.cc/

ГДЕ ДОСТАВКА КОКАИНА В РУКИ - https://koks24.cc/

ГДЕ ЗАКЛАДКА КОКАИНА ОНЛАЙН - https://koks24.cc/

ТУТ ССЫЛКА В ТЕЛЕГРАММ - https://koks24.cc/

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Теги поисковых слов для запроса "Где Купить Кокаин В Москве и Питере"

Где Купить Кокаин в Москве и Питере?

Как Купить закладку Кокаина в Москве и Питере?

Цена на Кокаин в Москве и Питере?

Купить Кокаин с Доставкой в руки в Москве и Питере?

Сколько Стоит Кокаин в Москве и Питере?

Почему так просто Купить Кокаин закладкой в Москвеи Питере?

Гарантия на Кокаин в Москвеи Питере?

Купить Кокаин с Гарантией?

Круглосуточные магазины Кокаина в Москве и Питере?

Оптовые и Розничные продажи Кокаина в Москве и Питере?

Купить Кокаин в Москве и Питере через Телеграмм?

Лучший Кокаин Купить в Москве и Питере?

Купить Кокаин в Москве и Питере по скидке и хорошей цене?

Купить Кокаин в Москве и Питере через свой телефон или ноутбук можно легко?

Сколько где Кокаина стоит цена?

Как купить Кокаин в Москве и Питере если нет очень много денег и нужно угостить девушку?

С кем можно разделить грамм Кокаина в Москве и Питере?

Не плохой или хороший Кокаин можно Купить в Москве и Питере на своей улице закладкой?

Кокаин Купить Где Москва и Питер ?

Основные теги - Купить Кокаин в Москве, Купить Кокаин в Новосибирске, Купить Кокаин в Санкт-Петербурге, Купить Кокаин в Екатеринбурге, Купить Кокаин в Казани,

Купить Кокаин в Нижнем Новгороде, Купить Кокаин в Красноярске, Купить Кокаин в Челябинске, Купить Кокаин в Уфе, Купить Кокаин в Самаре,

Купить Кокаин в Ростове на Дону, Купить Кокаин в Краснодаре, Купить Кокаин в Омске, Купить Кокаин в Воронеже, Купить Кокаин в Перьми, Купить Кокаин в Волгограде.

Дополнительные теги - Купить Шишки в Москве, Купить экстази в Москве , Купить гашиш в Москве, Купить мефедрон в Москве, Купить экстази в Москве, Купить МДМА в Москве,

Купить лсд в Москве, Купить Амфетамин в Москве, Купить скорость альфа ПВП в Москве, Купить гидропонику в Москве, Купить метамфетамин в Москве, Купить эйфоретики в Москве,

Купить закладки в Москве, Купить ШИШКИ закладкой в Москве , Купить Стимуляторы в Москве, Купить Галлюцыногены в Москве, Купить Наркотики закладкой в Москве. Тег окончен

novo pet - Sup Grils

I apologise, but, in my opinion, you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will communicate.

Alinadop - Pohled na kufry předních světových designérů, to je opravdu zajímavé!

Ahoj všichni!

Jak vnímáte počítačovou grafiku a design?

Jednou jsem začal procházet práci předních designérů a stalo se to mým koníčkem, počítačová grafika umožňuje dělat

krásná díla, designová řešení a reklamní kreativy.

Mimochodem, všimla jsem si, že to rozšiřuje obzory a přináší mi klid do života!

Doporučuji datové profily mistrů:

https://dprofile.ru/from_idea_to_you/collections

https://dprofile.ru/case/20894/function%20()%20%20%5Bnative%20code%5D%20

https://dprofile.ru/shywood/story/3

https://dprofile.ru/iwa/collection/1300/knigi

https://dprofile.ru/anastasiaemelianova/cv

https://dprofile.ru/dmitry_krasilnikov/cv

https://dprofile.ru/rmntrs/collection/815/followers

https://dprofile.ru/muntjac/cv

https://dprofile.ru/case/32147/function%20()%20%20%5Bnative%20code%5D%20

https://dprofile.ru/case/44127/function%20()%20%20%5Bnative%20code%5D%20

https://dprofile.ru/case/32684/function%20()%20%20%5Bnative%20code%5D%20

https://dprofile.ru/cases/search?City=1&hasAchievement=all&sort=date&city=928

https://dprofile.ru/case/5673/function%20()%20%20%5Bnative%20code%5D%20

https://dprofile.ru/t.yaroffical/story/3

https://dprofile.ru/users/search?type=all&sort=followers&filter=6&Filter=121

https://dprofile.ru/jvt/cv

https://dprofile.ru/case/2478/function%20()%20%20%5Bnative%20code%5D%20

https://dprofile.ru/arthur/cv

https://dprofile.ru/tmukhor/story/2

https://dprofile.ru/case/21174/function%20()%20%20%5Bnative%20code%5D%20

Hodně štěstí!

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242

IrinaLic - https://clck.ru/36Evsz